Interest on calls in advance Accountancy

Contents:

Interest at a rate 10% shall have to be paid on Calls-in-arrears for the period from the day fixed for payment and the time of actual payment thereon. If nothing is specified, there is no need to take the interest on calls-in-arrears account. Y Ltd. forfeited 100 equity shares of ₹ 10 each for the non-payment of first call of ₹ 2 per share. If any amount, called in respect of a share, is not paid before or on the date fixed for payment thereof, such amount which is not paid, is called “CALLS-IN-ARREARS”. Amount may be called up by the Company either as Allotment Money or Call Money. Thus, in case, any default on account of not sending the call money, is known as “CALLS-IN-ARREARS” and separate account i.e.

The amount paid in advance can be adjusted when the calls are actually made. An interest can also be paid if the Articles so authorize. Where it is agreed that the interest be paid, it may be paid out of capital, if profits are not available. However, the shareholder cannot claim repayment of the amount except in the event of winding up. Such shareholders rank after creditors in respect of advance, but in priority to the other shareholders. A shareholder can pay the whole or part of the amount remaining unpaid on his shares even before the call is made.

Types of Acquisitions Study material notes on different types of acquisitions, acquisition, compare acquisition and merger, and other related topics. Get all the important information related to the CBSE Class 12 Examination including the process of application, important calendar dates, eligibility criteria, exam centers etc. Interest-Only Period means the period from and including the first Borrowing Date and through and including the sixteenth Payment Date following the first Borrowing Date. Payment Date Advance Reimbursement has the meaning set forth in Section 8.03 of the 20[•]-[•] Servicing Supplement.

Reserve Capital It is that portion of uncalled share capital which shall not be capable of being called up except in the event and for the purpose of the company being wound up. Share Capital It is that part of the capital of a company, which is represented by the total nominal value of shares, which it has issued. The amount is known as paid-up capital, and the charge of interest at 10% p.a is chargeable in the call of arrears. Though, it depends on the provision of the articles of the company itself. The company directors have the right to cut off or wave off the interest rate on arrears calls.

Calls in Advance: (4 Accounting Entries)

Interest on calls-in-advance is paid at a specified rate, as provided in the Articles of association. Table ‘A’ of Companies Act provides payment of interest on calls-in-advance @ 6% p. a. The company can charge interest on all such calls in arrears for the period the amount remain unpaid at the rate of 5% p.a.

The purpose of creating __________ capital is to assure security to unsecured creditors. Interest on calls in advance will be allowed @ ______ p.a. Maximum paid-up capital in case of OPC is restricted to rupees ______. Minimum subscription amount must be received within _____ subscription list.

Call in advance needs to be credited to the calls in the https://1investing.in/. Calls-in-Advance generally arises when there is an over subscription of shares. Here, the excess application money received is adjusted against the amount due on allotment or calls. The excess application money after adjust¬ment for allotment is transferred to an account named as Calls-in-Advance Account, if the articles so provides. Sometimes, few shareholders may prefer to pay the entire amount at the time of allotment.

Journal Entry

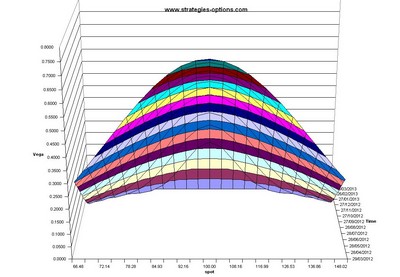

INTEREST ON ADVANCESshall be payable in arrears on the last day of each month. The directors decided to charge and allow interest, as the case may be, on calls in advance and calls in arrears. Show the journal entries needed to record the above transactions, including cash, and show how these appear in the balance sheet.

Calls in advance is shown separately, in the Balance Sheet as liability of the company under the heading ‘Current Liabilities’ until the calls are made and the amount actually becomes payable by the shareholder. A company may pay interest on such amounts received in advance at the rate of 6% p.a. No dividend on calls in advance is given to the shareholder because it is not treated as a part of called-up capital. Pass the necessary journal entry for the amount received by opening ‘Calls-in-arrears’ and ‘Calls-in- advance’ account in the books of the company. Issue of shares at discount can be issued only to directors and employees of a company.

If the Articles of the Company are silent about the rate of interest on calls-in-advance, then rate of interest is 6% p.a. Such an interest is a charge on profits and has to be paid to the concerned shareholder even if there is no profit. If any amount that is called in respect of a share is not paid before or on the date fixed for payment, such an amount is known as calls in arrears. The Money received by the company in excess of what has been called up is known as “CALLS IN ADVANCE”. A Company may, if authorised by its Articles, accept calls in advance from its shareholders. If such an amount, which has not been called, is received, such amount to be credited to a separate account known as CALLS-IN-ADVANCE ACCOUNT.

Calls in Arrears Journal Entry

Calls in Arrears are deducted from the called-up capital to determine paid-up capital. Use the above-provided NCERT MCQ Questions for Class 12 Accountancy Chapter 6 Accounting for Share Capital with Answers Pdf free download and get a good grip on the fundamentals. Need any support from our end during the preparation of CBSE Class 12 Accountancy Accounting for Share Capital MCQs Multiple Choice Questions with Answers then leave your comments below.

- It comes under the name of current liabilities till the calls are made, and the amount becomes payable by the shareholders.

- On the other hand, calls in arrears represent the unpaid-up amount on shares which is due but not yet received.

- If interest is not paid as and when it is due, it shall be added to the principal, become and be treated as a part thereof, and shall thereafter bear like interest.

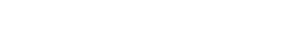

- These types of losses can be catastrophic if not properly hedged.

- A company is authorised to charge Interest on Calls in Arrears from the due date to the date of actual payment at a rate specified in the articles of the company.

Indian Companies Act, 2013 administers all companies and provides guidelines for them to follow. When one or more shareholders fail to pay the amount due from them towards allotment and/or calls, such dues are called calls-in-arrears. If call amount is due from any of the directors, secretaries and treasurers, it should be shown separately in the Balance Sheet.

Further, the amount received in advance is a liability for the company and so it is indicated separately at the liabilities side of the balance sheet and not included in the capital. At times, the company’s shareholder pays a portion or full of the amount due on the shares held in advance. It is an important fact that calls in advance never form a part of the share capital, even though it is being paid by the shareholders. An authorized company can accept calls in advance from its shareholders but the amount of call in advance in the journal entry cannot be credited to the capital amount.

The company forfeited these shares and later reissued 800 of the forfeited shares @ ₹ 7 per share fully called up. On 1st April 2020, the company issued 60,000 shares at a premium of ₹ 2 per share to be received with allotment. It received applications for 55,000 shares which were duly allotted. Money received in excess on shares partially allotted was retained to the extent possible. Show the cash book and journal entries assuming that all the installments were duly received and interest was paid by the directors on calls-in-advance @ 6.1% per annum on 1st October, 2012. The amount received as calls-in-advance is a debt of the company, the company is liable to pay interest on the amount of Calls-in-Advance from the date of receipt of the amount till the date when the call is due for payment.

- And, finally, the total is brought to the balance sheet as a deduction from the Called up Capital.

- When any shareholder fails to pay the amount due on allotment or on any of the calls, such amount is known as ‘Calls-in-Arrears’/’Unpaid Calls’.

- Company can exceed the limit of nominal capital through alteration in the memorandum of association.

- Suppose a Company issued 1000 shares of ₹ 100 each, in which ₹ 20 per share is payable on application, ₹ 30 per share is payable on the allotment, ₹ 30 per share on the first call, and ₹ 20 per share on the second and final call.

The amount so received from the shareholders is known as “Calls in Advance”. The amount received in advance is a liability of the company and should be credited to ‘Call-in-Advance Account.” The amount received will be adjusted towards the payment of calls as and when they become due. Table A of the Companies Act provides for the payment of interest on calls in advance at a rate of 12% per annum. Company accounts are a condensed summary of all sorts of financial activities of the company that it has committed in a period of twelve months. Company accounts include all sorts of financial statements ranging from the financial Balance Sheets, the Profit and Loss Statement to the Cash Flow Statement. The contributions done by the actual investors of the company which are always paid in advance are shown as calls in advance.

Get answers to the most common queries related to the CBSE Class 12 Examination Preparation. Interest Only Loan means a Mortgage Loan which only requires payments of interest for a period of time specified in the related Mortgage Note. If a company has not prepared its own Article of Association, then Table A of Companies Act, 1956 is applicable. According to Table A of Companies Act, interest on Calls-in-Advance @ is payable at 6% p.a. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

FACT SHEET: President Biden’s Budget Lowers Housing Costs and … – The White House

FACT SHEET: President Biden’s Budget Lowers Housing Costs and ….

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

Calls-in-arrears When one or more shareholders fail to pay their dues at the time of allotment or call, it is technically called calls-in-arrears. Share According to Section 2 of the Companies Act, 2013, share means a share in the share capital of a company and includes stock. The capital of company is divided into a number of equal units. A company may divide its capital into share of Rs 100, Rs 50, Rs 10, Rs 5 or even Rs 1 each. A call in arrears is the amount the defaulter shareholder calls up by the company, whereas the call in advance is the advanced amount received from shareholders in the company.

Thus, it means the amount of nominal value interest on calls in advance-up by the company to be paid by the shareholders towards the share capital. Equity shares According to Section 43 of the Companies Act 2013, equity share is that share which is not a preference share. Equity shares are the most commonly issued class of shares which carry the maximum ‘risks and rewards’ of the business. The risks being losing part or all of the value of shares if the business incurs losses, the rewards being payment of higher dividends and appreciation in the market value. Since the amount received as calls-in-advance is a liability of the company, it is liable to pay interest on the calls-in-advance from the date of receipt of the amount till the date when the call becomes due for payment.